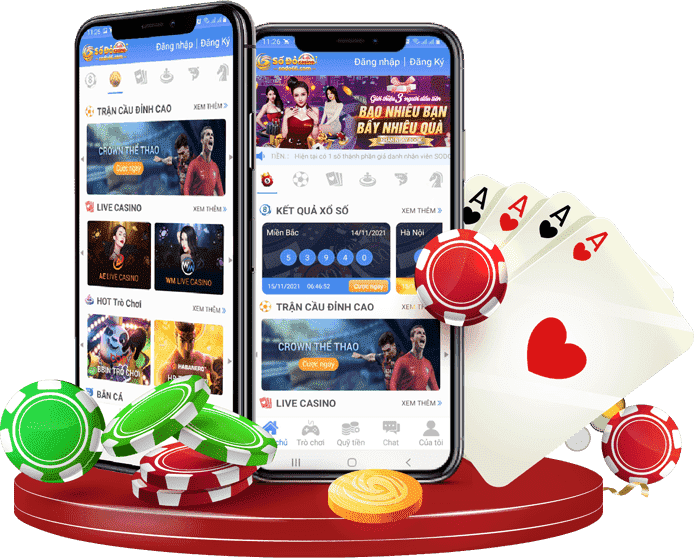

Trải Nghiệm Ứng Dụng

1. Quét mã QR bên dưới bằng điện thoại của quý hội viên.

2. Hội viên thực hiện theo hướng dẫn trên App Sodo.

3. Nếu bạn cần trợ giúp vui lòng quay lại trang và liên hệ với nhà cái.

Sodo là thương hiệu nhà cái đã có mặt rất lâu trên thị trường cá cược trực tuyến hiện nay, hiện vần đang thu hút đáng kể với sự quan tâm từ rất đông các cược thủ đẳng cấp đến từ châu Á, bao gồm cả Việt Nam.

Link truy cập 2025: https://techcommongood.com/

Sodo - Trang Chủ Chính Thức Của Sodo CasinoTrải Nghiệm Ứng DụngXóc Đĩa 30 Giây [...]

Sodo - Trang Chủ Chính Thức Của Sodo CasinoTrải Nghiệm Ứng DụngXóc Đĩa 30 Giây [...]

Sodo - Trang Chủ Chính Thức Của Sodo CasinoTrải Nghiệm Ứng DụngXóc Đĩa 30 Giây [...]

Sodo - Trang Chủ Chính Thức Của Sodo CasinoTrải Nghiệm Ứng DụngXóc Đĩa 30 Giây [...]

Sodo - Trang Chủ Chính Thức Của Sodo CasinoTrải Nghiệm Ứng DụngXóc Đĩa 30 Giây [...]

Sodo - Trang Chủ Chính Thức Của Sodo CasinoTrải Nghiệm Ứng DụngXóc Đĩa 30 Giây [...]

Họ tên: Trịnh Minh Hoàng - Minh Hoàng

Giới tính: Nam

Ngày sinh: 03/03/1993

Quê quán: Trà Vinh

Học vấn: Tốt nghiệp tại RMIT Việt Nam

Chào anh em! Tôi là Minh Hoàng – CEO sáng lập và vận hành nhà cái sodo.com.co. Với kinh nghiệm và chuyên môn trong lĩnh vực này, Hoàng đã xây dựng và phát triển sodo.com.co trở thành một trong những điểm cược hàng đầu tại Việt Nam. Dưới đây là một số thành tựu mà Hoàng đạt được tại sodo trong quá trình phát triển và vận hành nhà cái.

https://techcommongood.com/minh-hoang/